- Law & Society

- No Comment

Uwadiogbu Sonny Ajala v GTB: Court Dismisses Appeal, Orders Damages For Illegal Withdrawals From Customer’s Account

29th January 2025, NewsOrient, Law And Society, News

By Samuel Egburonu, Editor

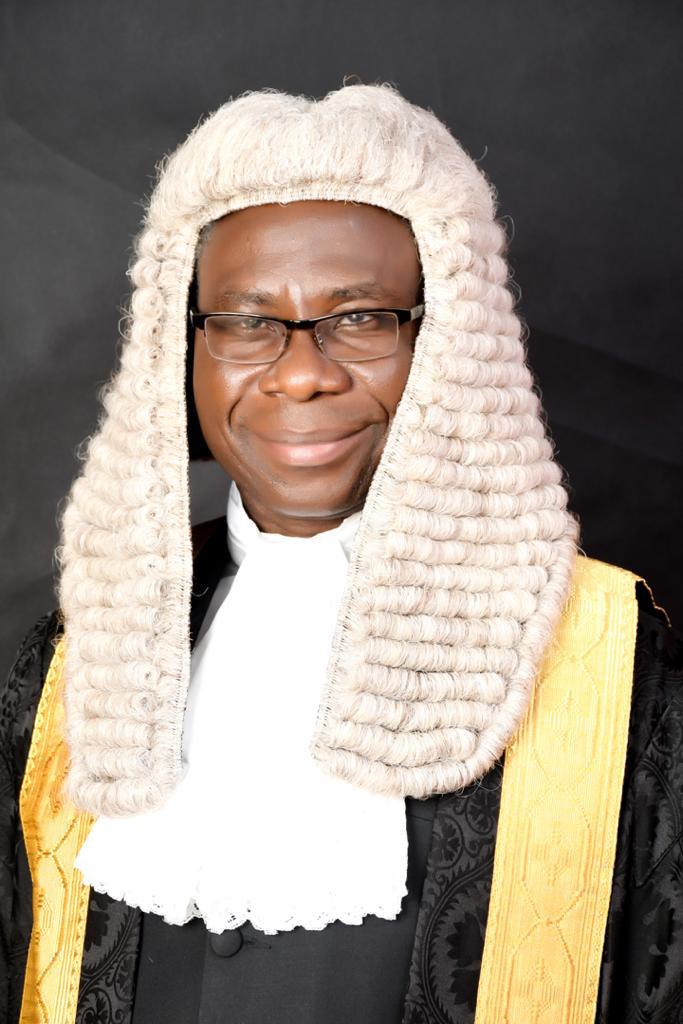

The High Court of the Federal Capital Territory, Abuja, has dismissed an appeal brought before it by Guarantee Trust Bank (GTB), challenging the judgment earlier given against it in 2021 by a District Court in Abuja, directing it to pay one million naira as damages to it’s customer, Dr Uwadiogbu Sonny Ajala SAN for negligence and breach of duty of care which led to illegal and unauthorized withdrawals from the customer’s savings account with the bank.

In it’s judgment on the appeal, delivered by Hon Justice A. S. Adepoju (Presiding Judge), Hon Justice A. Y. Shafa (Hon Judge) the court ruled: “On the whole, this appeal is lacking in substance and devoid of all merit, it is hereby dismissed. The judgment of the lower court, having been resolved in favour of the respondent, is hereby affirmed.”

In his notice of appeal, the appellant had denied liability for the multiple unauthorized withdrawals from the bank account of the respondent, contending that the respondent compromised his personal identification details.

The court disagreed with the appellant but instead affirmed the judgment of the lower court which held that banks have a duty of care to safeguard funds in their customer’s accounts and which therefore awarded one million naira damages (N1m) damages against him and in favour of the plaintiff.

NewsOrient recalls that the trial court, a District Court sitting at the Federal Capital Territory, Abuja, had ordered Guaranty Trust Bank PLC to pay the sum of I million Naira to its customer, Dr. Sonny Ajala, SAN, as compensation for illegal and unauthorized withdrawals made from his savings account.

A report in TheNigerianlawyer dated June 21, 2021 said Dr Ajala had in July, 2019, initiated a legal action against Guaranty Trust Bank PLC, for unauthorized and illegal withdrawals from his savings account with the bank.

Dr Uwadiogbu Sonny Ajala’s particulars of claim was that his savings account “was illegally debited on the 28th, 29th, 30th, and 31st May, 2019, for various sums amounting to N37,400.”

He said he discovered the unauthorized transaction on the 29th May, when he received an alert via his email and immediately called the bank’s online Customer Care number.

Upon inquiry, he was told that the payments “were Taxify services rendered in Lagos.”

He immediately instructed the online Customer Care representative to block his debt card to prevent POS from further transaction.

The following day, being 30th May, he submitted letter to the Guaranty Trust Bank PLC, which was acknowledged same day by the Bank’s branch in Gwarinpa.

On that 30th May, Dr. Ajala, SAN, still received debt from his account amounting to N11,000, despite his earlier instructions to GTBank to block his debt card.

He however, denied comprising his Personal Identification Number,(PIN) and insisted that he was not in Lagos at the time of the transaction in this case.

Dr. Ajala testified before the court that he was not in Lagos at the material time of the use of the taxify app for payment of the ride nor does he have/use the taxify app.

It was also the evidence of Dr. Ajala before the court that taxify app that is electronic-based thereby making it possible for GTBANK to retrieve the biodata of the client of the taxify merchant just like it’s easy for the taxify merchant and GTBANK through the banking clearing system to identify the receiver of the illegal payments for nine times from his account with GTB.

In defence, a staff of GTBank, who is the account officer to Dr. Ajala, SAN, said the transactions were effected using the plaintiff’s PIN on the website belonging to Taxify.

She also insisted that the transactions wouldn’t have been completed without using his PIN. She also said that she is not one of the persons authorized to view the platform where the details of the transactions were done.

The distinctive feature of the case is that it was not mere cash withdrawals from the account of Dr. Ajala but traceable electronic payments for nine times via taxify app that Dr. Ajala, SAN has never activated and he was not in Lagos at the material as Dr. Ajala resides in Abuja with his debit card firmly in his closet.

In it’s judgement, the court ordered Guaranty Trust Bank PLC to immediately refund to Dr. Ajala, SAN, the sum of N37,400 with an interest of 10% from 31st of May, 2019 to the date of the judgment.

His Worship Nweke, in his judgment held that GT Bank had duty to safeguard the funds of Ajala but she failed in that regard.

“Going by the evidence before the court, which shows that the plaintiff’s account was debited on the 30th, 31st of May, 2019, despite instructions given both verbally and in writing by the plaintiff to block the debt card, there’s no explanation given by the defendant’s witness as to how the plaintiff’s debit card was still used by the plaintiff or whoever he allegedly disclosed his personal identification number (PIN), to, subsequently he had instructed that the card be blocked.

“The defendant has the duty to the plaintiff to safeguard funds in his account. He failed in his duty when even after the plaintiff had reported the fraudulent transactions and demanded that his debit card be blacklisted but the defendant failed to do so.

“The Defendant’s assertion that the plaintiff compromised his PIN was not in any way established before the court.

“I found from the evidence before me that the Defendant was negligent. He had a duty of care, well established which was breached and the results were lost of funds of the plaintiff.

“I, therefore, found that the plaintiff has established his case against the Guaranty Trust Bank…

“The judgment is entered in favour of the plaintiff in the following terms:

“GTBANK is ordered to immediately refund to the plaintiff the sum of N37,400 with an interest of 10% from the 31st of May, 2019 to the date of this judgment.

“GTBANK is ordered to pay to Dr. Ajala, SAN the sum of 1 million Naria (N1,000,000), as damages for negligent in handling of the plaintiff’s account.

“The court also awards 25% both Judgment sum per annum from the date of this judgment until full liquidation,” The Nigerialawyer reported then.

Commenting on why he undertook to pursue the matter, Dr Uwadiogbu Sonny Ajala SAN told NewsOrient: “I pursued the case in the interest of the public. The members of the public need to know of judicial cover available to them when they are victims of unauthorized debits in their accounts with deposits taking institutions.”

~ NewsOrient

For News, Interviews, Special Events Coverage, Advertisements, Corporate Reports, etc., Contact:

Email: Newsorientng@gmail.com

Website: https://newsorientng.com

Phone: +2348023165410; +2348064041541